Bankruptcy Attorney Tulsa: Understanding Exemptions And Non-dischargeable Debts

It can damage your credit history for anywhere from 7-10 years as well as be a challenge toward obtaining safety clearances. Nonetheless, if you can not solve your troubles in less than 5 years, personal bankruptcy is a sensible option. Legal representative charges for insolvency differ relying on which develop you pick, how complex your instance is and where you are geographically.

Other personal bankruptcy expenses include a filing cost ($338 for Phase 7; $313 for Chapter 13); as well as fees for credit scores therapy and monetary monitoring courses, which both expense from $10 to $100.

Other personal bankruptcy expenses include a filing cost ($338 for Phase 7; $313 for Chapter 13); as well as fees for credit scores therapy and monetary monitoring courses, which both expense from $10 to $100.

You do not constantly require a lawyer when filing individual insolvency by yourself or "pro se," the term for representing on your own. If the case is basic sufficient, you can declare bankruptcy without assistance. Many people benefit from representation. This short article clarifies: when Phase 7 is as well complicated to manage on your own why working with a Phase 13 legal representative is constantly vital, and also if you represent on your own, how a personal bankruptcy application preparer can aid.

The basic policy is the easier your insolvency, the better your chances are of finishing it by yourself and also obtaining a personal bankruptcy discharge, the order getting rid of financial debt. Your situation is likely simple adequate to manage without an attorney if: Nonetheless, even simple Chapter 7 instances need work. Strategy on submitting comprehensive paperwork, collecting economic documents, investigating bankruptcy and also exemption regulations, as well as following regional guidelines and procedures - Tulsa bankruptcy lawyer.

Tulsa Bankruptcy Attorney: Expertise Matters In Complex Cases

Here are two scenarios that constantly call for representation., you'll likely want a legal representative.

If you make a mistake, the insolvency court might throw out your situation or offer possessions you assumed you can keep. If you lose, you'll be stuck paying the financial debt after bankruptcy.

You may want to submit Chapter 13 to capture up on home mortgage debts so you can keep your residence. Or you might wish to do away with your bank loan, "cram down" or minimize a cars and truck funding, or pay back a financial debt that will not go away in personal bankruptcy in time, such as back tax obligations or support debts (Tulsa bankruptcy attorney).

In numerous cases, an insolvency attorney can promptly recognize concerns you may not find. Some people data for bankruptcy because they do not comprehend their alternatives.

Bankruptcy Lawyer Tulsa: Understanding Home Equity And Bankruptcy Exemptions

For many customers, the logical choices are Phase 7 and also Phase 13 visit homepage bankruptcy. Each type has particular advantages that resolve particular issues. For example, if you want to save your home from repossession, Chapter 13 might be your best option. Chapter 7 could be the way to go if you have low income and no possessions.

Right here are usual concerns insolvency legal representatives can prevent. Personal bankruptcy is form-driven. Several self-represented insolvency debtors do not file all of the needed bankruptcy records, and their situation obtains disregarded.

If you stand to shed important building like your home, vehicle, or other property you care about, an attorney might be well worth the money.

Bankruptcy Attorney Tulsa: How To Rebuild Your Credit Post-bankruptcy

Or something else may appear. The lower line is that an attorney is crucial when you locate yourself on the receiving end of a movement or lawsuit. If you determine to file for bankruptcy by yourself, discover what solutions are offered in your area for pro se filers.

Others can attach you with legal aid companies that do the very same. Many courts as well as their web sites know for customers filing for personal bankruptcy, from sales brochures explaining inexpensive or complimentary solutions to detailed info concerning personal bankruptcy. Obtaining an excellent self-help publication is additionally a superb suggestion. Look for a bankruptcy publication that highlights scenarios requiring an attorney.

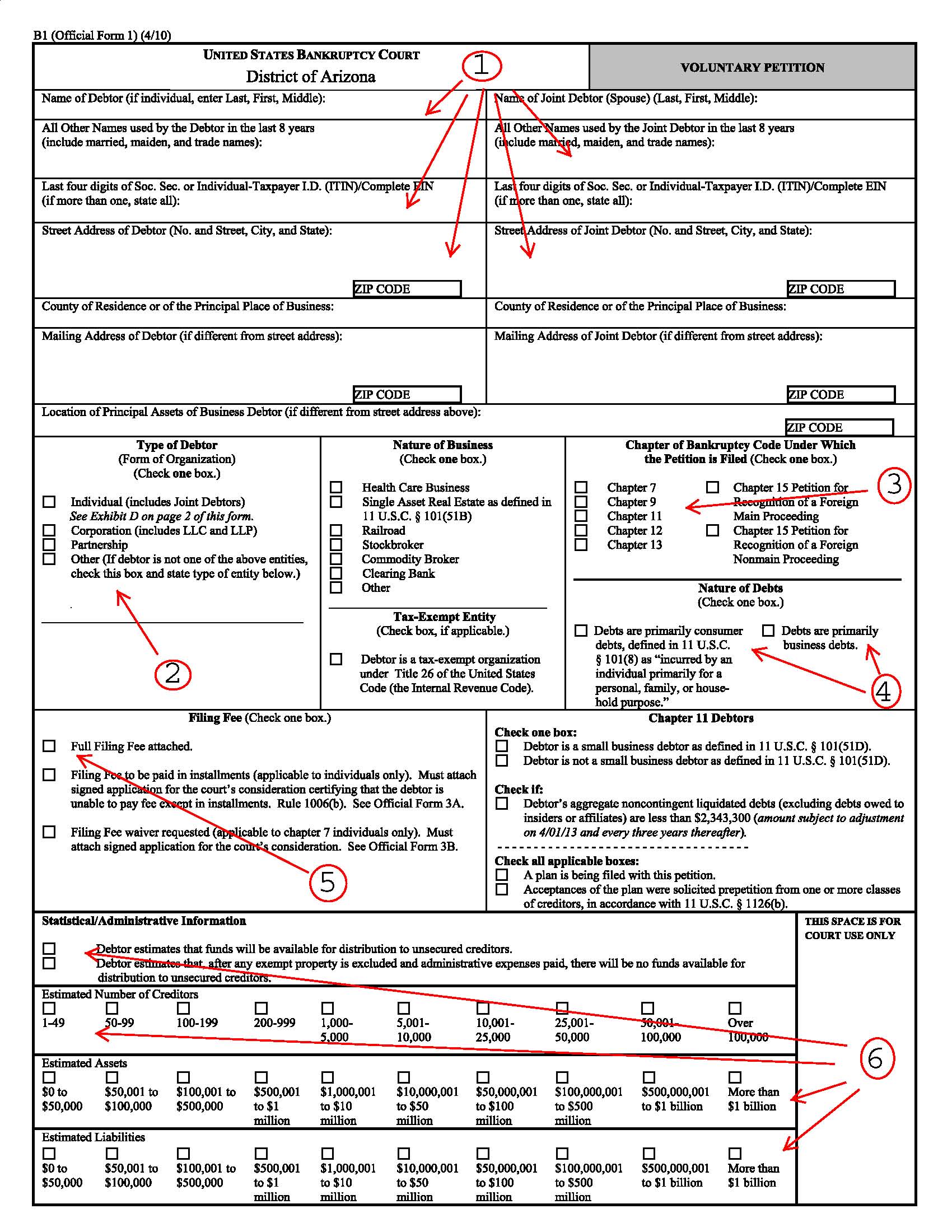

Others can attach you with legal aid companies that do the very same. Many courts as well as their web sites know for customers filing for personal bankruptcy, from sales brochures explaining inexpensive or complimentary solutions to detailed info concerning personal bankruptcy. Obtaining an excellent self-help publication is additionally a superb suggestion. Look for a bankruptcy publication that highlights scenarios requiring an attorney. You should accurately load out several forms, research study the legislation, as well as attend hearings. If you understand insolvency law yet would such as assistance completing the kinds (the standard insolvency petition is roughly 50 pages long), you could take into consideration employing a personal bankruptcy request preparer. A bankruptcy application preparer is anyone or company, various other than an attorney or a person who helps a legal representative, that charges a fee to prepare personal bankruptcy documents.

You should accurately load out several forms, research study the legislation, as well as attend hearings. If you understand insolvency law yet would such as assistance completing the kinds (the standard insolvency petition is roughly 50 pages long), you could take into consideration employing a personal bankruptcy request preparer. A bankruptcy application preparer is anyone or company, various other than an attorney or a person who helps a legal representative, that charges a fee to prepare personal bankruptcy documents.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more

Since insolvency application preparers are not lawyers, they can not provide legal recommendations or represent you in bankruptcy court. Particularly, they can not: inform you which type of insolvency to submit inform you not to note specific financial debts tell you not to list certain possessions, or inform you what residential or commercial property to excluded.

Comments on “Tulsa, Ok Bankruptcy Attorney: Strategies For Managing Bankruptcy Stress”